Industrial Goods Consulting

EUROPE’S INDUSTRIAL TRANSITION

From Cost Pressures to Digital Transformation: The New Industrial Reality

The European Industrial Goods market is facing threats from multiple sides. Inflation in the Eurozone has eased, offering companies some breathing space as financing conditions stabilize, albeit at a relatively high level. Yet persistent challenges remain: supply chain disruptions, tariffs, reduced export volumes, uneven demand, and cost pressures continue to weigh on margins – keeping manufacturers cautious. At the same time, digitalisation, automation, and robotics are reshaping the sector. Firms that combine cost discipline with investment in advanced technologies are best placed to secure long-term competitiveness.

More than 25 Years of Experience

Shaping Industrial Goods Across Three Core Areas

In Industrial Goods, we bring together deep industry knowledge and hands-on experience to support our clients in addressing today’s most important challenges. Our work covers three core areas: Plant Engineering, Machine Engineering and Components, enabling us to deliver tailored solutions that meet the specific needs of each segment.

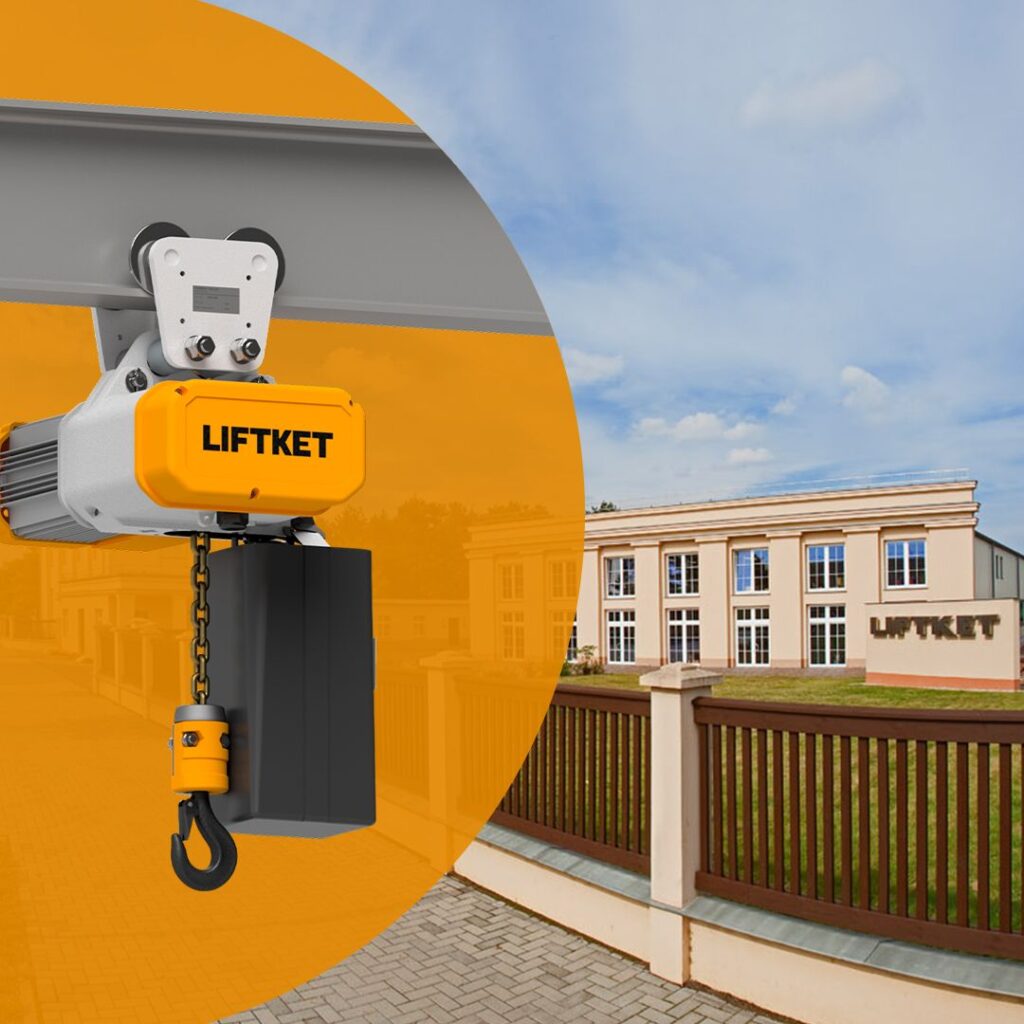

Plant Engineering

By combining engineering, procurement, and construction expertise with advanced technologies, we create end-to-end production plants for sectors including energy, oil and gas, chemicals, and pharmaceuticals.

Machine Engineering

Project and contract manufacturing with a strong focus on development, resulting in customised solutions for small production volumes.

Components

Highly standardised machine components produced in medium to large volumes, often supplied to machine and plant manufacturers.

How We improve your performance

Our consulting services drive measurable efficiency by reshaping business models, achieving substantial cost reductions, and enabling scalable international growth across operations, supply chains, and organisations.

Move beyond products: unlock recurring revenues and stronger customer ties

Equipment-only business models are increasingly commoditized, with shrinking margins. Customers expect integrated, digital-first experiences and service-driven value. We design service-based revenue models and new customer journeys that generate recurring income streams, deepen client relationships, and increase lifetime customer value — securing 5-10% recurring top-line growth beyond product sales.

Free up hidden capital: fuel growth without external financing.

Liquidity is trapped in working capital and tied up in inefficient CAPEX allocation. With high interest rates, poor cash management limits flexibility and competitiveness. We unlock 15-30% of revenue in free cash, reduce financing needs, and increase investment capacity for strategic initiatives — improving both resilience and shareholder returns.

Scale digital and AI to deliver measurable impact, not isolated pilots.

Many companies experiment with AI and digitalisation but fail to scale successfully. Disconnected initiatives create cost without delivering real business outcomes. We embed digital and AI into strategy, operations, and people — delivering 10%increase profit margins, 15% increased production output, accelerated decision-making, and new digital revenue streams. Our “Digitalisation Check” ensures investments translate into tangible business performance.

Find your optimal footprint: reduce cost, increase agility, and secure resilience.

Manufacturing footprints are often the result of legacy decisions, not current or future market realities. Overcapacity in some regions, exposure to geopolitical risks, and high energy costs erode profitability and flexibility. We design a manufacturing footprint aligned with market demand, supply stability, and cost efficiency. Clients achieve 10–20% lower factor costs, improved resilience against disruptions, and faster time-to-market for customers.

Turn complexity into efficiency: achieve more with the same resources.

Process silos and inefficiencies drive delays, high operating costs, and reduced competitiveness. In volatile markets, inefficiency directly undermines margins and customer trust. Through lean methods and process redesign, we deliver productivity improvements of 15-20%, reduce defect rates, and shorten lead times — allowing clients to scale operations without scaling cost.

Build an organization that performs today and adapts tomorrow.

Complex structures, unclear accountability, and slow decision-making reduce responsiveness. Ineffective organisations waste talent and delay execution, especially in volatile markets. We create streamlined structures and a performance-driven culture, enabling faster decision-making, higher employee engagement, and 10–20% cost savings in SG&A. Clients gain an organisation that is both efficient and agile

Engineer smarter, not cheaper — maximize customer value while minimizing cost.

In a market where price pressure and global competition keep tightening margins, product design and cost structure have become decisive levers of performance. Traditional cost-cutting often undermines innovation — but Cost Value Engineering (CVE) finds the balance between functionality, quality, and cost.

We help clients redesign products end-to-end, applying engineering, procurement, and manufacturing expertise to eliminate non-value-adding cost. The result: 10–20% product cost savings, improved margin resilience, and enhanced customer value — without compromise on performance.

Cut material costs while building a supply chain that never breaks.

Supply chains face disruption, price volatility, and overdependence on few suppliers. Standard cost-down tactics no longer secure competitive advantage. By applying advanced procurement levers, diversifying suppliers, and embedding risk management, we deliver material 5–15% cost reductions while improving resilience — ensuring continuity of supply and margin stability.

Tracking Trends in the Industrial Goods Industry Since 2023

H&Z Industrial Goods Pulse Check

SUCCESS STORIES

How We Help Industrial Goods Leaders Succeed

Our Latest Insights on Industrial Goods

Get in Touch with Our Industrial Goods Experts

For tailored advice and insights on the Industrial Goods industry, our experts are available to support you with strategic and operational guidance. You can set up a consultation directly or contact our experts via email or LinkedIn. We look forward to connecting with you.