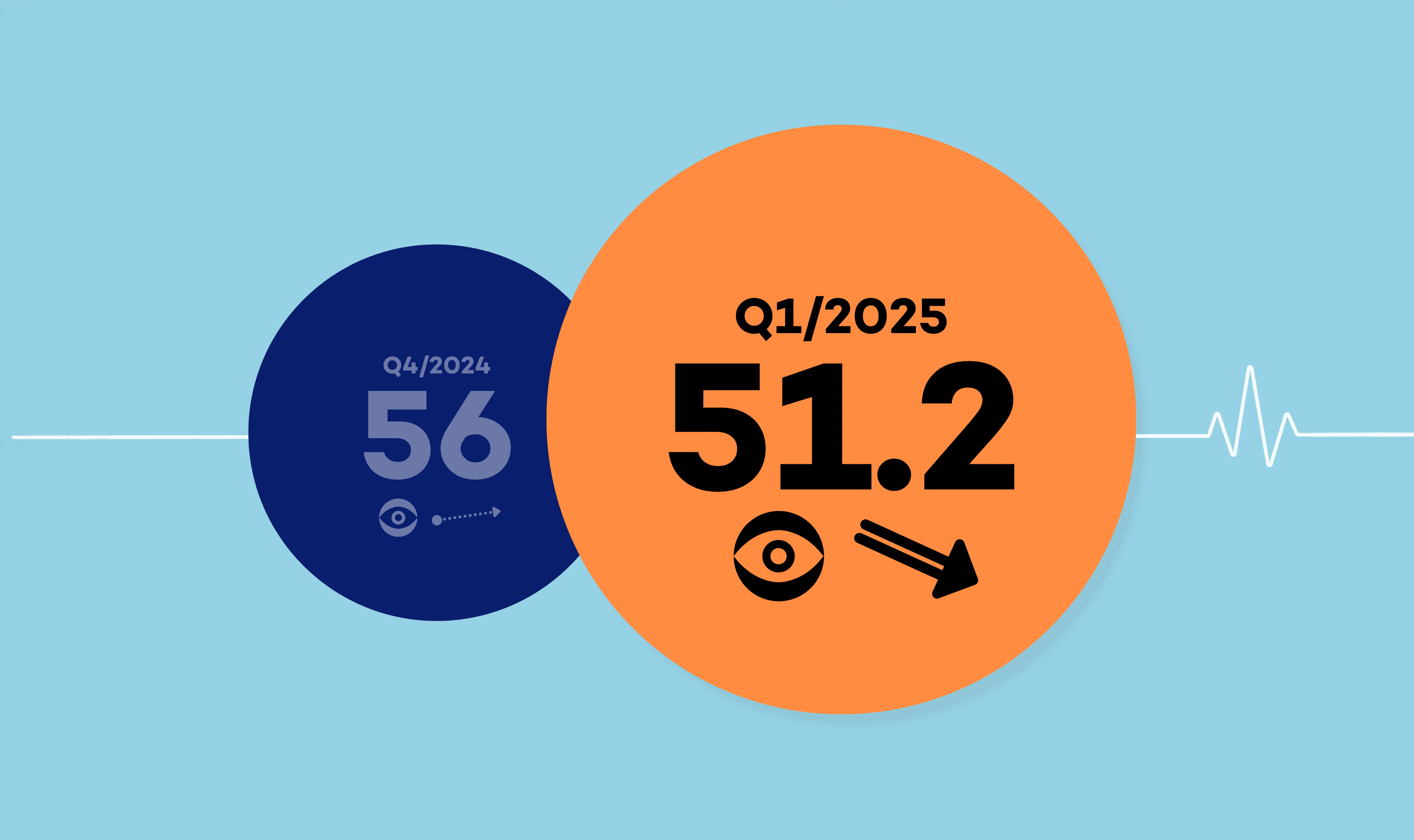

CPO Outlook Q1/2025

Procurement and Supply Chain sentiment drops – the lowest since Q1/2023

- Latest European CPO Outlook Sentiment Indicator: 51.2

- Declining by 3.8 points from last quarter (-6.9%)

- Concerns driven by global trade tariff volatility, corporate financial strain and economic uncertainty

- Tariff impact transparency and mitigation now the top CPO priority. Cost management and supply chain resilience remain key

Get the full picture below - explore the key factors behind this shift and what it means for procurement

- Home /

- Insights /

- Publications /

- CPO Outlook Q1/2025

The Outlook

Procurement sentiment continues to decline, reflecting increasing concerns over cost pressures and risk management

What’s driving this change?

- Tariff uncertainty, driven by tariff volatility from the Trump administration

- Corporate financial strain, with company profit margins under increased pressure from both labour cost increases and inflation

- Economic uncertainty, as the impact of geopolitics (reflecting in energy cost) and tariff uncertainty stall business decisions

- German economic weakness, as lower industrial output and lower global demand causes sluggish growth of Europe’s largest economy

- Investment in transformation is slowing, as businesses shift focus to short-term resilience

Procurement priorities remain heavily focused on cost, with supply chain resilience becoming increasingly important

Where are CPOs focusing their procurement strategies?

Short-term:

- Tariff impact; understanding the impact and implementing immediate mitigation strategies,

- Supply chain transparency; driven by the need for n-tier visibility and management in a rapidly changing trade environment,

- Cost; short-term cost initiatives to maintain EBITDA margin

Mid-term:

- Supply chain resilience, putting in place diversification/mitigation through domestic/near-shore dual/multi-source strategies,

- Cost considerations, continue to drive sourcing decisions, though risk mitigation is growing in importance,

- Strategic supplier relationships are becoming an essential focus as businesses seek longer-term supply-base stability,

- Digitalisation in procurement, as AI-equipped tools provide deeper insight and potential to deliver more-with-less

Looking Forward

Procurement leaders are expected to prioritise stability over transformation in the coming months, with cost containment and supply chain resilience remaining dominant themes. As economic uncertainty persists, investment in digitalisation and long-term initiatives may slow, while risk mitigation and supplier collaboration take centre stage. The outlook suggests a more cautious, pragmatic approach to procurement strategy, with organisations focusing on short-term adaptability rather than large-scale structural change.

Contact us to find out what this means for your organisation

Connect with our experts to discuss how these trends impact procurement strategy and what steps you can take to stay ahead.