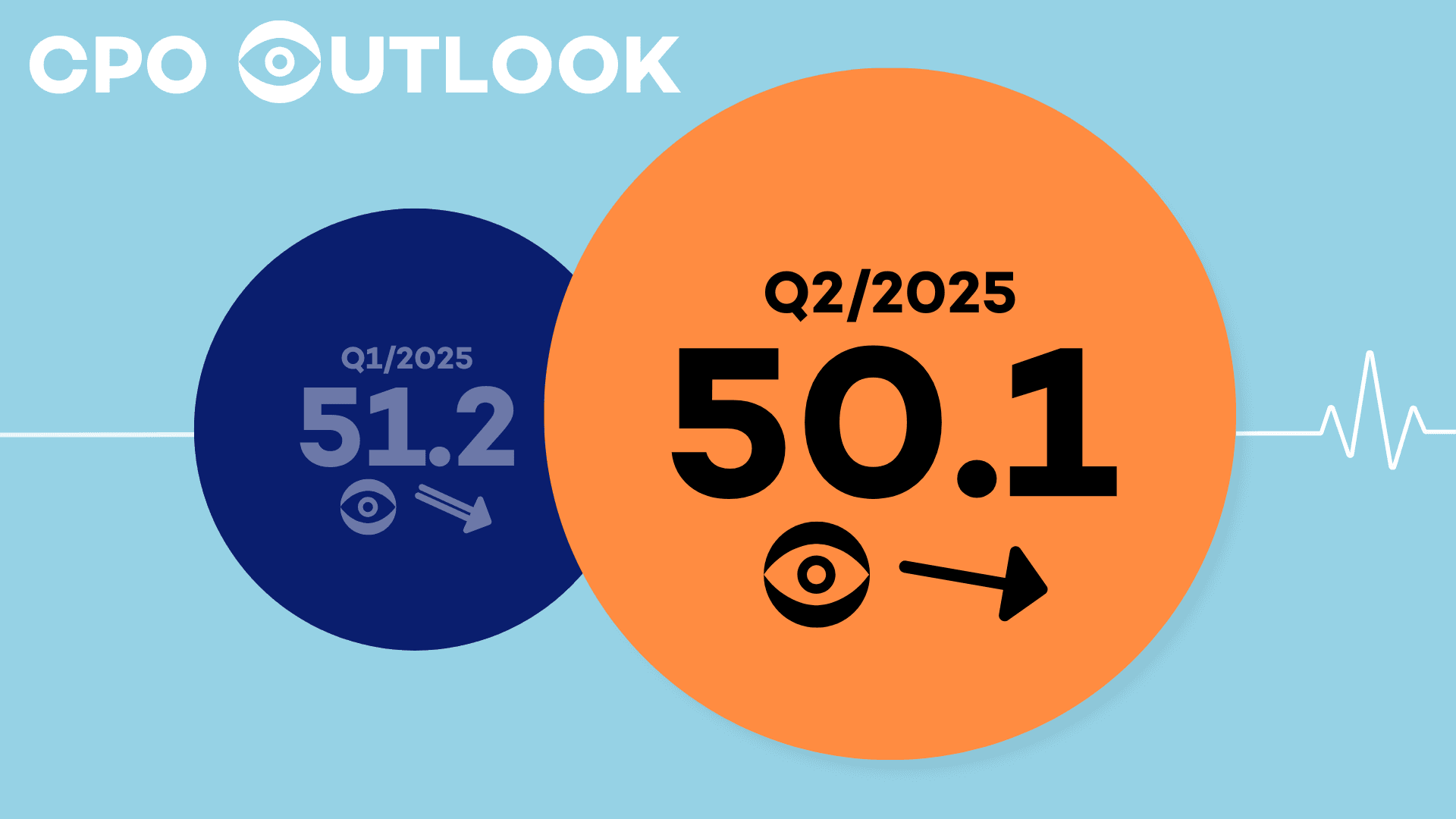

H&Z CPO Outlook Q2/2025

Procurement sentiment slips closer to neutral, the lowest since Q1/2023 as cost and compliance pressures intensify.

- Latest European CPO Sentiment Index: 50.1

Down 1.1 points from last quarter (-2.1%)

Uncertainty from shifting tariff policies, rising operating costs, and tightening regulations is pushing procurement leaders to refocus on cost control and resilience.

Cost now leads sourcing priorities, overtaking sustainability and innovation. Supplier diversification, nearshoring, and analytics are gaining momentum — while long-term transformation takes a back seat.

Get the full picture below - explore the key factors behind this shift and what it means for procurement

The Outlook: Eurozone Supply Chain Sentiment Drops to Lowest Level Since 2022 Amid Growing Market Volatility

What’s driving this change?

- Ongoing tariff uncertainty, with uneven preparation for U.S. policy shifts

- Rising cost pressure, forcing companies to double down on short-term savings

- Geopolitical instability, from global conflicts to regulatory disruption

- Inconsistent risk management, with many firms reacting ad hoc

- Strategic reprioritisation, as cost and quality take precedence over sustainability

- Reduced planning reliability, making long-term transformation harder to justify

Quality (27%) and Cost (30%) First: Reliability and Excellence Regain Top Priority Amidst Shifting Sustainability Focus

Short-term focus (based on immediate impacts and actions)

- Cost-out initiatives, to protect margins under inflation and regulatory strain

- Supplier diversification, to reduce exposure to geopolitical and tariff risks

- Nearshoring and reshoring, to boost supply stability amid global uncertainty

Contract adjustments, reacting to shifting legal and compliance environments

Mid-term focus (based on strategic responses and planning)

- Procurement analytics and forecasting, to improve resilience and scenario planning

- Long-term supplier partnerships, aiming to stabilise supply chains under pressure

- Organisational change, including realignment of procurement processes

- Compliance readiness, with more focus on regulatory adaptation and ESG tracking

Looking Forward

Procurement leaders are shifting from transformation to tactical execution. As uncertainty around tariffs, costs, and compliance grows, organisations are prioritising control over change.

The focus will stay on cost reduction, risk mitigation, and strengthening supplier relationships. While digital tools and analytics are gaining relevance, long-term innovation and sustainability efforts may continue to take a back seat. Expect a pragmatic, resilience-first approach — with flexibility and speed valued over strategic overhaul.

Understand what this means for your organisation

Connect with our experts to discuss how these trends impact procurement strategy and what steps you can take to stay ahead.